Well, 2022 is finally behind us and for most investors and traders, it was a tough year.

The S&P 500 took a nosedive, dropping 19.7% and the Nasdaq 100 performed even worse losing more than 33% of its worth.

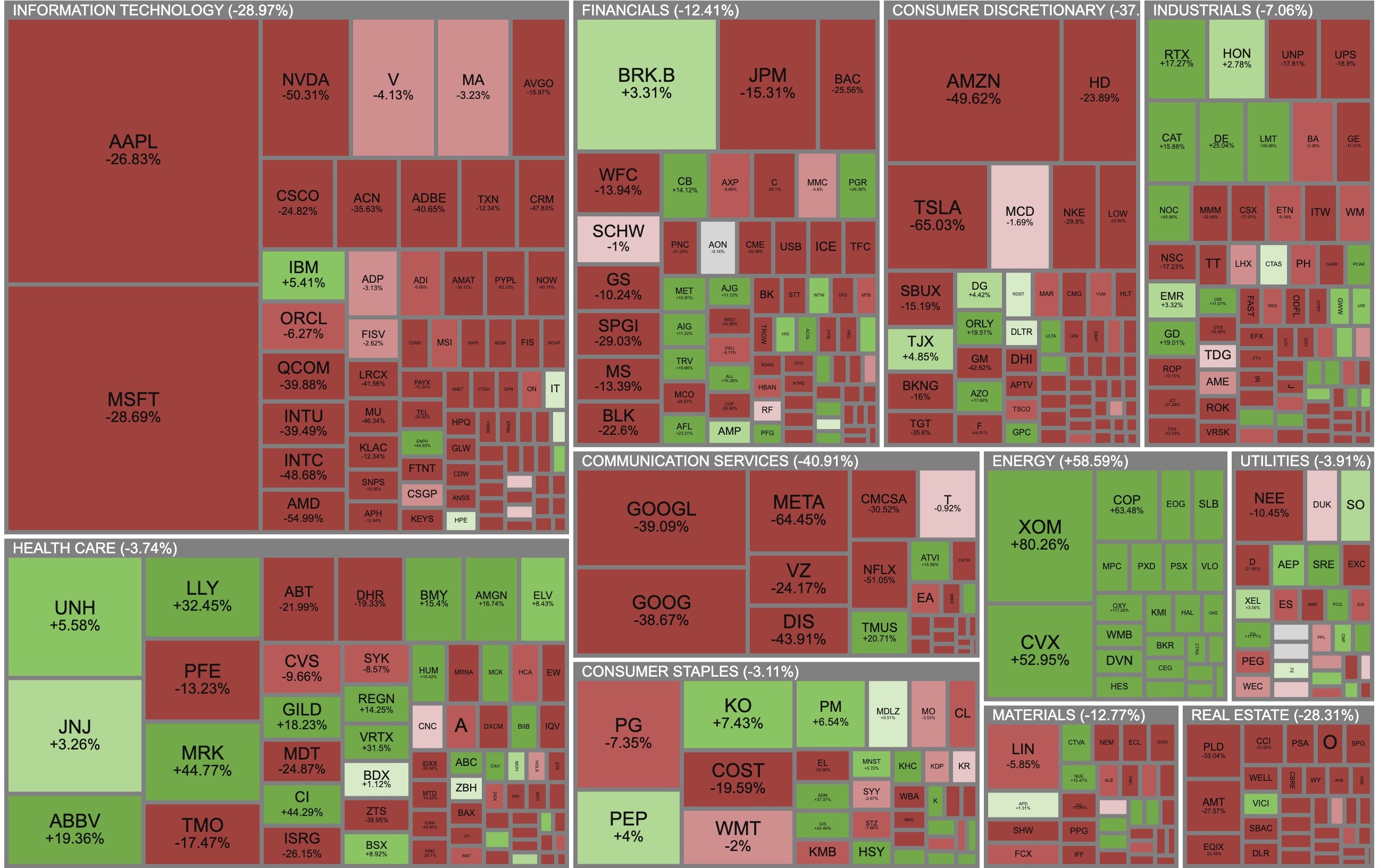

Looking at the S&P 500 heatmap below, it is easy to see which sectors suffered the most:

The End Of Cheap Money

While the tech driven sectors are deep in the red barring a few surprises (IBM, I see you there), The much smaller energy sector is deep in the green.

I guess that’s what we get from years of cheap money finally coming to an end abruptly with interest rate hikes, and a war in Europe that directly impacts energy prices worldwide.

With monthly interest rate hikes brought upon us to fight inflation, money is no longer cheap, growth has slowed down and valuation for hyper-growth companies has deflated significantly.

Feel free to play around with the heatmap yourself and come up with your own conclusions.

Another indicator of the effects of money no longer being cheap is the Crypto space. Bitcoin lost more than 64% of its worth, dropping from $46,300 all the way down to $16,611.

Ether dropped similarly from $3,682 down to around $1200.

Sure, there were a few other reasons for crypto to go down…

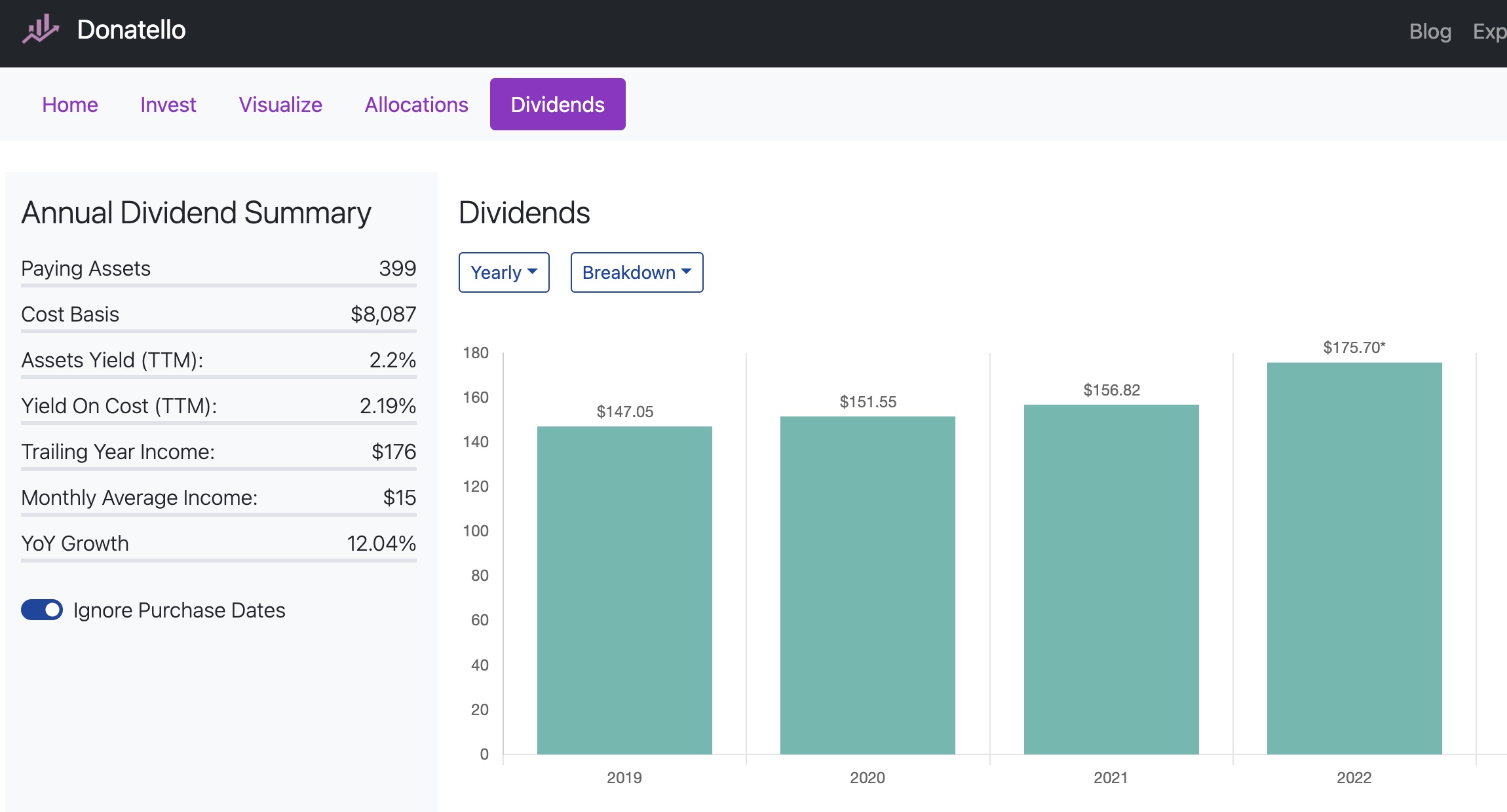

On the dividend front, the picture is a bit more surprising

Looking at 2022 compared to previous years, the S&P 500’s dividend yield has hardly been impacted and even grew by 12% year over year.

Here’s what investing $10,000 in all of the companies in the S&P 500 weighted appropriately looks like over a 4 year window in terms of dividends:

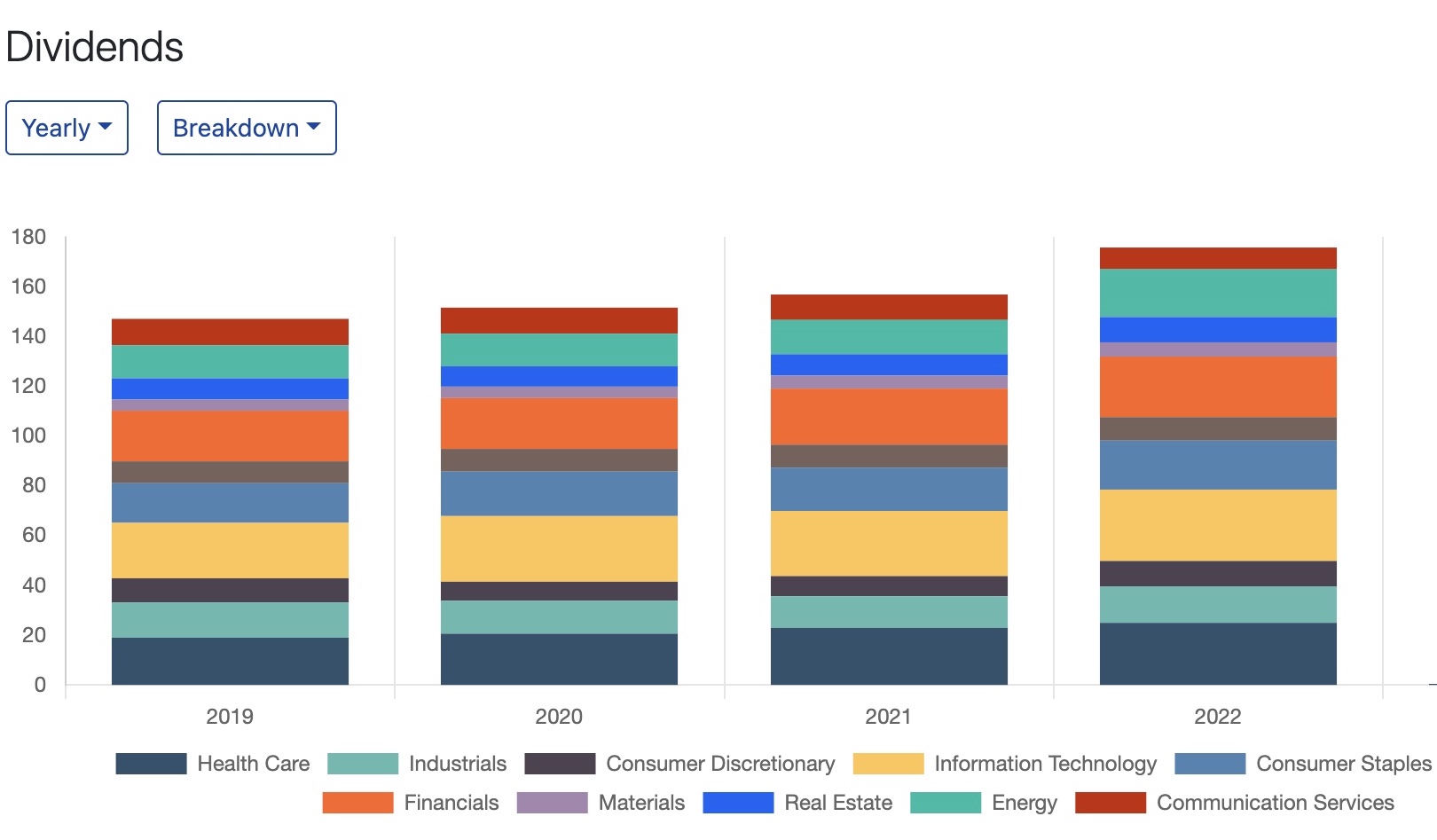

Breaking it down by category, there’s no specific sector that suffered more than others, it seems that all sectors (including information technology and communication services that took the biggest hit this year) increased their dividend at roughly the same pace.

This is probably in line with the fact that while valuations have shrunk, most mature companies that pay dividends did not suffer a significant loss of earnings, otherwise, we would have seen significant pay cuts.

While valuations sometimes lie, dividend payments simply cannot lie for very long (the money they are paying has to come from somewhere).

Here at Donatello, we added lots of new capabilities like a brand new dividends page with the ability to break down your income and track inflows, just upload your portfolio and watch the magic.

We also added the ability to mark a previously held security as sold in order to keep the history of your returns and dividends on your favorite wealth management app while maintaining an accurate picture of your wealth.

Finally, there’s the ability to track assets that are not securities (be it your pension fund, your savings account or something else), these are now available when one chooses to add a “Fixed asset” on the main page.

So what’s to be expected in 2023?

I’m not a prophet, and I have no clue on what’s to come.

I recently read that many expect the market to continue to trend down in 2023.

But on the other hand, didn’t these same people say that they expect 2022 to be a positive year in the markets with only a minor slowdown? 🤷♂️

As for Donatello, we plan to roll out delayed real time prices for the portfolio heatmap in the very near future, and later in the year, roll out more technical data of companies that are being held.

We have a lot more to come, Stay tuned!

🍇🍇🍇 Have a great 2023 and may your investments grow like grapes that thrive on the vine 🍇🍇🍇.